ODSP is a social assistance program that provides a minimal level of income and medical assistance for people with a disability in Ontario.

Understanding how to qualify and then apply for the Ontario Disability Support Program (ODSP) is a great first step; however, once you have successfully qualified for this support, it is also very important to understand how the program works, and what the restrictions are, so that you will continue to receive the benefits if needed.

Using ODSP

Using ODSP

Qualifying for ODSP

Qualifying for ODSP

- Live in Ontario

- Have a disability, that is expected to last one year or longer and substantially limits your ability to work, look after yourself or carry out daily activities.

- Must demonstrate financial need.

ODSP is a means-tested program. This means when applying for ODSP you must show you need financial support. This also means that if you qualify for ODSP there are financial restrictions you must be aware of to maintain your eligibility. You must demonstrate your income and assets do not exceed the ODSP limits which are:

- $40,000 in liquid assets for an individual,

- $50,000 in liquid assets for a couple.

|

Liquid assets include stocks and bonds, money in the bank, RRSPs, TFSAs and/or GIC’s, etc.

Assets that are NOT considered liquid assets and DON’T impact ODSP eligibility include:

|

An individual is allowed up to $1,000 per month in employment income. Any amount after the first $1,000 is multiplied by 75% and deducted from a person’s ODSP monthly cheque.

In addition, an individual is allowed up to $10,000 in voluntary payments used for non-disability - related expenses over a 12-month period without impacting their ODSP. Payments can include cash gifts from family or money withdrawn from a trust or segregated fund

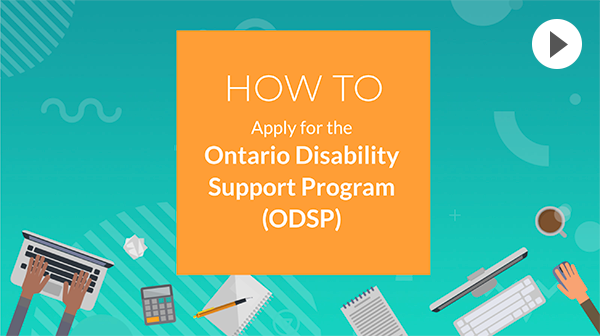

To apply for ODSP you will need the following documents on hand:

- social insurance number (SIN),

- OHIP card,

- birth certificate,

- immigration document,

- income tax return,

- and up-to-date banking information

|

Once you are ready, applicants can apply by phone, online or in person at the ODSP office closest to you. |

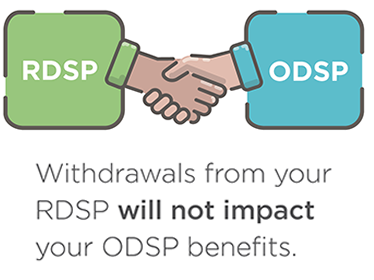

Protecting and Managing your ODSP

To ensure you receive the full amount of ODSP each month, you must be aware of allowances and restrictions. Assets and exemptions, inheritances and gifts, a Henson Trust and RDSP income – each of these things will either protect or limit a recipient’s monthly ODSP income.

To maintain your ODSP reporting on the following items are required by the recipient to the ODSP office:

- Any assets owned or accrued while receiving ODSP – this will include a new second car or home or a financial gift,

- Any income earned above the allowable amount of $200 a month,

- Any material changes to the recipient’s situation.

To find your local ODSP office CLICK HERE